Muskoka Catastrophic Injury Lawyer

Find out if you have a case today.

Contact our Muskoka catastrophic impairment injury lawyers for a free consultation if you have legal questions regarding your catastrophic impairment injury claim.

Table of Contents

Motor vehicle collisions can have devastating consequences for accident victims in Muskoka. Survivors of these traumatic events may sustain a range of injuries which can significantly impact their lives.

Although accident victims whose injuries are minor non-catastrophic may return to their regular pace of life relatively quickly, those who have been catastrophically impaired as a result of their motor vehicle collisions may find themselves struggling with the resulting physical limitations, psychological difficulties, and financial challenges for the rest of their lives. Coping with the fallout of these devastating motor vehicle accidents often requires physical stamina, emotional fortitude, and robust financial support.

That is why the Ontario Statutory Accident Benefits Schedule (SABS) requires all basic auto insurance plans in the province to include provisions for no-fault accident benefits. Regardless of who was directly responsible for the accident, anyone injured in a motor vehicle collision in Ontario should be entitled to certain accident benefits to offset the costs of injury-related expenses.

The SABS specifies the amount of accident benefits that must be included in all insurance plans. The following accident benefits could be made available to motor vehicle collision survivors depending on the severity of their accident-related injuries:

- $3,500 in medical and rehabilitation benefits for accident victims who sustained minor injuries

- $65,000 over 5 years for the combined total costs of medical, rehabilitation, and attendant care benefits for accident victims who sustained non-minor, non-catastrophic injuries

- $1 million for life in combined medical, rehabilitation, and attendant care benefits for accident victims who sustained catastrophic injuries

Since catastrophic impairments can be permanent and require ongoing expenses, individuals who have sustained these kinds of injuries are entitled to higher amounts of accident benefits. However, insurers may dispute or deny claims, leaving victims to fight back against unfair practices.

The SABS provides specific eligibility criteria for accident benefits commensurate with catastrophic impairments. To qualify for this level of insurance coverage, individuals must have suffered one of the following outcomes as a result of their accident:

- Paraplegia or Tetraplegia

- Severe impairment of ambulatory mobility or use of an arm; or Amputation

- Loss of Vision of Both Eyes

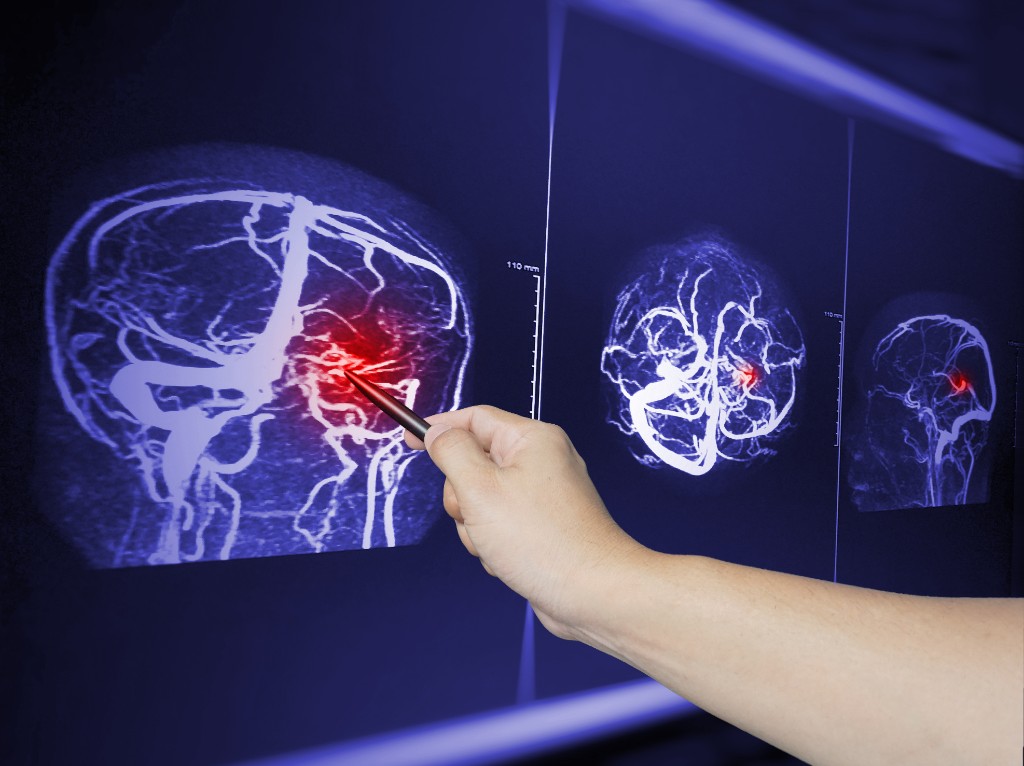

- Traumatic Brain Injury (TBI) meeting the Glasgow Outcome Scale-Extended (GOS-E) criteria

- Physical Impairment or Combination of Physical Impairments (which results in 55% or more of whole person)

- Mental or Behavioural Impairment (excluding Traumatic Brain Injury) Combined with a Physical Impairment (which results in 55% or more impairment of the whole person)

- Marked impairment in three or more areas of function that precludes useful functioning; or an Extreme impairment in one or more areas of functioning due to mental or behavioural disorder

This standardized eligibility criteria should provide clear factors to be considered by insurers when determining whether an accident benefits claimant meets the threshold of catastrophic impairment. A claimant’s application for a catastrophic impairment designation should be supported by a physician or medical expert familiar with their injuries.

Unfortunately, in spite of the provincially mandated eligibility criteria and recommendations of qualified physicians supporting applicants’ claims, insurance providers often find ways to reduce the amount of accident benefits they offer to catastrophically impaired collision survivors. Insurers might also deny an applicant’s claim for accident benefits for a number of reasons, many of which can seem incomprehensible to individuals struggling to rebuild their lives after sustaining catastrophic impairments.

If you believe your insurer is treating you unfairly, consider scheduling a free initial consultation with our Muskoka catastrophic injury lawyers.

Call Today For Personalized Legal Input

To speak with our catastrophic injury lawyers serving Muskoka about your experience with your insurer and learn about options that might be available to you, contact us today. During a free initial consultation, our Muskoka catastrophic injury lawyers may be able to help you understand your rights and provide insights as to how we may be able to help you through this challenging process. Do not hesitate to call our offices and take advantage of your free initial consultation with our catastrophic injury lawyers serving Muskoka.

Proudly Canadian

Award Winning Personal Injury Law Firm

We are proud to be one of Canada’s oldest and long-standing personal injury law firms. Since 1959, we have been providing exceptional legal services and have established ourselves as leading personal injury lawyers in the Canadian legal community. It’s not just the awards that recognize our achievements, but also the wins we’ve achieved for thousands of Canadians with their catastrophic impairment injury claims.

More catastrophic impairment injury Topics

Here’s more information on catastrophic impairment injury related topics that we think you might find helpful.

catastrophic impairment injury

|

August 9, 2021

Defining Permanent Serious Impairment or Injuries in a Personal Injury Case

Last month in the Ontario Superior Court of Justice, the defendant in a personal injury action stemming from a car accident contested the severity of…

catastrophic impairment injury

|

March 5, 2021

The Human Cost of Traumatic Brain Injuries

Acquired brain injuries sustained through traumatic events, such as motor vehicle collisions or slip and fall accidents can have profound, devastating effects on accident victims,…

catastrophic impairment injury

|

July 8, 2014

Factors Considered When Determining Catastrophic Impairment

Regardless of their severity, the injuries sustained in a motor vehicle accident can disrupt a person’s regular routine. Certain injuries may require hospitalization, physiotherapy, rehabilitation,…

Got more questions?

If you have more questions or need legal help regarding catastrophic impairment injury claims, contact our legal team for help.

We’re happy to help.

INJURED IN AN ACCIDENT IN Muskoka?

Book a FREE Consultation

With Our Legal Team Today

Our phone lines are available 24/7

During your free consultation you will find out if you have a case worth pursuing as well as answers to any legal questions you may have.