December 19, 2025 | rideshare accident Claims

What To Do After A Rideshare Accident In Toronto

Table of Contents

If you were injured in an accident involving an Uber, Lyft, Hopp, or other rideshare vehicle in Toronto, you are not alone. Ridesharing has become part of everyday life in the city, but when something goes wrong, figuring out which insurance policy applies and who should pay for your losses can be confusing.

Since the mid-2010s, Toronto has seen a rapid expansion of rideshare services, and the City now regulates companies like Uber and Lyft as “private transportation companies” under its Vehicle-for-Hire Bylaw. Ontario has also approved special fleet insurance policies for rideshare platforms, such as the Intact policy that provides different levels of coverage depending on whether a driver is waiting for a request, en route to a passenger, or carrying riders.

Our guide helps accident victims navigate the rideshare landscape while keeping a practical focus on what they should actually do after a crash. Whether you were a rideshare passenger, another driver, a cyclist, or a pedestrian, the steps you take in the hours and days after a collision can help protect both your health and your potential claim.

To find out more about your options for compensation, schedule a free consultation with one of our Toronto car accident lawyers today.

Why Rideshare Accidents Are Different From Other Toronto Car Crashes

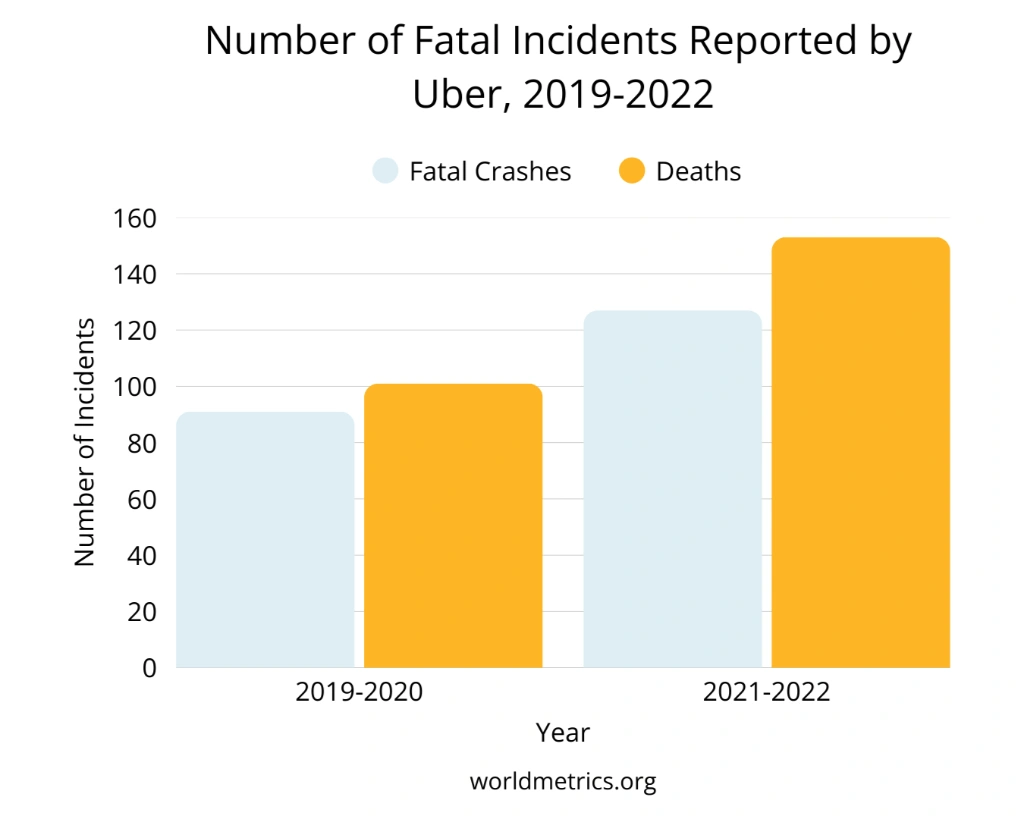

Considering that, on average, 9.4 crashes per million Uber trips are reported globally each day, with a 12% annual increase as of 2025, rideshare accidents pose a serious risk. While rideshare collisions still count as motor vehicle accidents under Ontario law, there are some important differences.

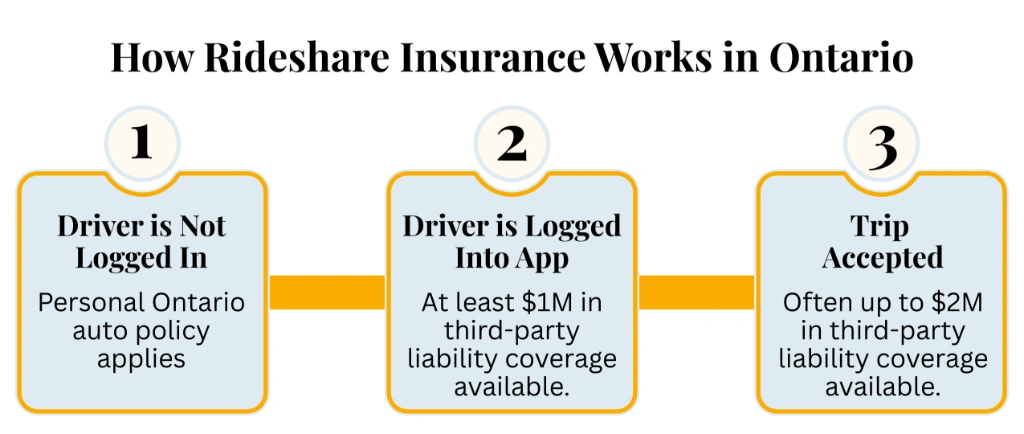

In some cases, multiple insurance policies may be involved. A rideshare driver can be covered by their personal auto insurance, the rideshare company’s commercial fleet policy, or both, depending on what they were doing in the app at the time of the crash.

Coverage may also change by “phase” of the trip. For many platforms, once a driver logs into the app and makes themselves available, a commercial policy with at least 1 million dollars in third-party liability coverage is active, which usually increases to 2 million dollars from the moment a trip is accepted until the final passenger exits.

City regulations also apply to rideshare accident cases. Toronto’s Vehicle-for-Hire Bylaw sets rules for vehicle condition, insurance, driver behaviour, and more for private transportation companies. These factors can affect your claim, depending on the circumstances of your accident.

Because of this mix of municipal rules, Ontario’s no-fault Accident Benefits system, and commercial fleet coverage, rideshare cases often require a careful look at app data, insurance contracts, and the timing of events in the moments before and after the collision.

What To Do Immediately After A Rideshare Accident In Toronto

If you are able to do so safely, the following steps can help protect your well-being and your potential claim after an Uber accident, Lyft accident, or other rideshare collision in Toronto.

Make Safety The First Priority

Move to a safe location away from traffic if you can. Call 911 if anyone appears injured, if there is serious damage to vehicles, or if you suspect impaired or dangerous driving. Ontario’s traffic laws require that collisions causing injury or significant damage be reported to police within 24 hours.

2. Get Medical Attention Right Away

Even if you feel “okay,” some injuries take time to show up. See a doctor as soon as possible so your symptoms are documented in your medical records. This can be important later when you apply for Statutory Accident Benefits or pursue a claim against an at-fault driver.

3. Gather Information At The Scene

If you are able to remain at the accident location, try to collect:

- The rideshare driver’s name, contact information, licence plate, and insurance details.

- Screenshots from your rideshare app showing the driver’s name, vehicle, trip route, time, and fare.

- Names and contact information for any independent witnesses.

- Photos or short videos of vehicle damage, road conditions, traffic signals, skid marks, and any visible injuries.

If police attend, ask how you can obtain the accident report number.

4. Report The Collision Through The App

Most rideshare platforms require that accidents be reported through the app or a support link. Submit a brief, factual description of what happened. You do not need to guess about fault or provide a detailed medical history at this stage.

5. Notify Your Own Auto Insurer

Even if you were a passenger and not driving, you may need to claim Accident Benefits through your own Ontario auto insurer first under the priority rules in the Statutory Accident Benefits Schedule.

In general, you should:

- Tell your insurer about the collision and your injuries within 7 days, or as soon as reasonably possible.

- Complete and return the Accident Benefits application package (OCF-1 and other forms) within 30 days of receiving it, if you can.

If you do not have your own Ontario auto policy, you may still qualify for benefits through another household member’s policy, the rideshare company’s insurer, or, in limited circumstances, the Motor Vehicle Accident Claims Fund.

6. Consider Getting Legal Advice Before Giving Detailed Statements

Insurers and rideshare companies may contact you quickly for recorded statements or forms. Because what you say can affect how your claim is handled, many people choose to speak with a Toronto car accident lawyer or a Toronto rideshare accident lawyer first so they understand their rights and obligations.

How Rideshare Insurance Works In Ontario (Who Pays What?)

One of the most confusing parts of a rideshare accident is figuring out which insurance company should respond. For most types of motor vehicle accidents, Accident Benefits can normally be claimed through your own Ontario auto policy if you have one, regardless of who was at fault. Fault-based claims (tort claims/lawsuits) can also be made against the at-fault driver’s insurance (which may be the rideshare company’s fleet insurer) and sometimes other negligent parties.

For Uber and many other platforms, Ontario has approved a commercial fleet policy underwritten by Intact Insurance that applies:

- From the moment the driver logs into the app and is available for trips.

- While the driver is en route to pick up a passenger after accepting a ride request.

- During the trip, until the last passenger exits or the trip is ended in the app.

Different liability limits usually apply in each phase (for example, 1 million dollars in third-party liability coverage while the driver is waiting for a request, increasing to 2 million dollars after a trip is accepted and while passengers are on board).

If the driver is not using the app at the time of the collision, only their personal Ontario auto policy typically applies.

Because these overlap rules can be complex, especially if more than one rideshare app was in use, it can be helpful to have a lawyer review the circumstances, determine which insurer is first in line to respond, and help you pursue the correct combination of Accident Benefits and fault-based claims. This way, you can ensure that you receive the full amount of insurance coverage and/or compensation to which you are legally entitled.

Accident Benefits After A Rideshare Accident

If your collision involved a motor vehicle in Ontario, you may qualify for benefits under the Statutory Accident Benefits Schedule, even if you were a rideshare passenger, pedestrian, or cyclist.

Depending on your injuries and your policy, Accident Benefits can include:

- Medical and rehabilitation funding for treatment not covered by OHIP (for example physiotherapy, chiropractic care, psychological counselling, prescription medication, and assistive devices).

- Attendant care benefits if you need help with personal care.

- Income Replacement Benefits if you are unable to work (usually 70 percent of your gross weekly income, up to a standard policy limit, with optional higher coverage available).

- Non-Earner Benefits in certain cases if you were not employed, but your injuries seriously affect your normal life.

- Additional benefits in catastrophic cases or where optional coverages have been purchased.

Many soft-tissue injuries are treated under Ontario’s Minor Injury Guideline (MIG), which provides a fixed amount of funding for minor sprains and strains, while more serious impairments may fall outside the MIG and qualify for higher limits.

A Toronto accident benefits lawyer can help you understand what benefits may be available after a rideshare accident, gather medical evidence, and respond if your insurer reduces or stops benefits.

When You Might Sue An At-Fault Driver Or Rideshare Company

Accident Benefits are only one part of the system. If another driver, a rideshare driver, or even the rideshare company itself was negligent, you may also have a separate claim for additional compensation, often called a “tort” claim.

Through a tort claim, you may seek damages for:

- Pain and suffering

- Past and future loss of income and earning capacity

- Future care costs and other out-of-pocket losses

- Certain family-member claims under Ontario’s Family Law Act

Motor vehicle claims are subject to special rules in the Insurance Act and related regulations, including thresholds for recovering pain and suffering damages and deductible amounts that are indexed each year by Ontario’s financial regulator.

Because these rules are technical and change from time to time, it is recommended that you speak with a lawyer about whether your injuries may meet the threshold and how a deductible could affect any settlement or award.

Contact Our Toronto Rideshare Accident Lawyers Today

Navigating a rideshare accident claim often means dealing with at least one personal auto insurer, a rideshare company’s commercial fleet insurer, Ontario’s Accident Benefits rules, strict timelines, and complex fault and threshold issues all at the same time.

If you have been hurt in an Uber, Lyft, or other rideshare accident anywhere in Toronto, you do not have to figure this out on your own. Our rideshare accident lawyers in Toronto at Preszler Injury Lawyers can help you navigate insurance policies, the documentation process, and potential compensation.

You can contact Preszler Injury Lawyers for a free, no-obligation consultation to discuss what happened, what benefits and claims may be available, and how we may be able to help.

Blog Categories

Speak With Our

Legal Team for FREE

Find Out if You Have a Case in Under 5 Minutes

Speak to a Lawyer Now!

We’re here to help.