January 21, 2026 | accident benefits Claims

Why You Should Name All Drivers in Your Household On Your Auto Insurance

Table of Contents

In Ontario and most other provinces across Canada, all motorists are required to have auto insurance.

You cannot drive a motorized vehicle on public roads without insurance, and there are good reasons for this. If you are involved in an auto accident, your insurer will provide statutory accident benefits. And if another driver’s negligence causes your injuries, their insurer would be responsible for compensating you.

However, these protections only apply if your policy is valid, and this depends heavily on what you disclose when applying for or renewing your insurance.

In this article, we will explain:

- What Ontario drivers are required to disclose to their insurer

- Why listing all licensed household drivers is critical

- Common misunderstandings that lead to denied claims

- A real Ontario court case showing how serious the consequences can be

This context will help you understand why accurate disclosure matters and how families can avoid losing coverage when they need it most. If you have been in a motor vehicle accident and are experiencing difficulty claiming benefits from your insurer, contact Preszler Injury Lawyers today for a free consultation.

What You Must Disclose to Your Auto Insurer in Ontario

Beyond listing all licensed household members, Ontario drivers are required to disclose any “material change” that could affect the insurer’s assessment of risk.

This includes:

- A newly licensed driver moving into your home

- A household member upgrading from G1 to G2, or G2 to full G license

- A child returning home from school with a valid licence

- Someone in the home regularly using your vehicle

- Licence suspensions, traffic convictions, or accidents involving anyone with access to your vehicle

Failing to report these changes can give the insurer grounds to deny a claim or void the policy entirely.

Why Listing All Household Drivers Matters

When you apply for auto insurance in Ontario, your insurer assesses the driving risk of everyone in your household who holds a valid driver’s licence. This is because anyone living with you could reasonably have access to your vehicle, and therefore could be involved in an accident while behind the wheel.

Your premium is calculated based on this broader household risk profile. That means:

- Newly licensed or inexperienced drivers in the home might increase premiums

- High-risk or previously suspended drivers must be disclosed

- Even occasional or infrequent drivers living with you must be named

- A change in someone’s licence status (such as moving from G1 to G2) can affect the insurer’s willingness to provide coverage

Under Ontario’s Insurance Act, insurers are allowed to void coverage if a policyholder withholds or misrepresents a material fact.

The presence of an undisclosed driver is considered a material fact because it directly affects the risk the insurer is being asked to cover.

Many families mistakenly assume that a “full coverage” policy automatically extends to every person living in the home. However, auto insurance doesn’t work this way. Coverage depends on accurate disclosure, and a misunderstanding about who needs to be listed can lead to serious consequences, something made clear by Ontario court decisions.

Case Study: Seetaram v. Allstate Insurance Company of Canada

A decision of the Ontario Superior Court highlights exactly why it is so important to disclose all licensed drivers in your household. In Seetaram v. Allstate Insurance Company of Canada, the issue arose after an April 2013 collision involving a car and a motorcycle.

About two months after the incident, lawyers representing the motorcyclist sent notice to the owner and driver of the car. The lawyers said their client planned to file a personal injury lawsuit, and as such, they requested the appropriate insurance information from the owner and driver.

The driver was actually the son of the owner. The father previously purchased an Ontario auto insurance policy from Allstate, which is the respondent in this case. The initial purchase took place in April 2012. At that time, the son was “learning to drive at driving school,” according to court records, and he held a G1 license from the Ontario Ministry of Transportation. However, the father did not list his son as a “named insured” on the Allstate policy; only he and his wife were listed. The parents later testified in court that they assumed, incorrectly, that their “full coverage” policy automatically covered anyone living in their household.

In early 2013, the son received his G2 license. Two months later, and one day before the accident, the parents renewed their Allstate policy.

Once again, they did not list their son as a named insured, even though the renewal offer sent by Allstate directly asked the question, “Are any other persons in the household or business licensed to drive?”

After the accident, Allstate conducted an investigation. The father admitted his son was driving his car at the time. The father also reiterated that he believed that the “full coverage” of his Allstate policy automatically covered his son as a member of the father’s household.

In his own statement, the son admitted that he “hit a biker”–i.e., the motorcyclist–and that his G2 license was suspended sometime thereafter. The son further acknowledged he “drove away” from the accident scene before he was detained by law enforcement. The son also told Allstate that he was driving alone at the time.

Based on this information, Allstate sent the parents a written notice that their auto insurance policy was “void” as of the original 2013 purchase date. As such, the insurer would not pay for any damages resulting from the motorcyclist’s personal injury lawsuit. The parents and their son then filed an application with the Superior Court, asking for an order to declare the insurance policy was valid.

The Judge’s Decision

In a decision issued on January 25, 2019, Justice Benjamin T. Glustein dismissed the application. The judge did not directly address whether the parents’ insurance policy was void from the original purchase date, as Allstate maintained. Rather, the court focused on the 2014 renewal of the policy.

Justice Glustein explained that the standard Ontario Automotive Policy used by Allstate required policyholders to inform the insurer “of any change that might increase the risk of an incident or affect our willingness to insure you at current rates.” This includes adding drivers to the policy, as that can directly affect the premiums charged.

On this point, Allstate said the parents paid a stated premium of $2,112 for their insurance policy. But if Allstate had known a 17-year-old driver with a G2 license was also a named insured, that premium would have nearly doubled, to $3,954. From Allstate’s perspective, the son “was in a high-risk insurance category,” a fact belied by the accident.

As for the parents’ testimony that they did not know they needed to list their son, Justice Glustein held that was of no relevance.

As noted above, the insurance policy contained clear language informing the parents of their duty to inform Allstate that they were adding a driver. The parents should have read and understood their obligations. Even if they did not, ignorance is still no excuse. “An applicant for insurance cannot escape the effect of a misrepresentation in an application for insurance by stating, or proving, that he or she did not read the document before signing it,” Justice Glustein said.

Consequently, the parents have no insurance coverage to protect them from the potential damages a court may later award the motorcyclist. Justice Glustein also ordered the parents to pay $15,000 in costs to Allstate.

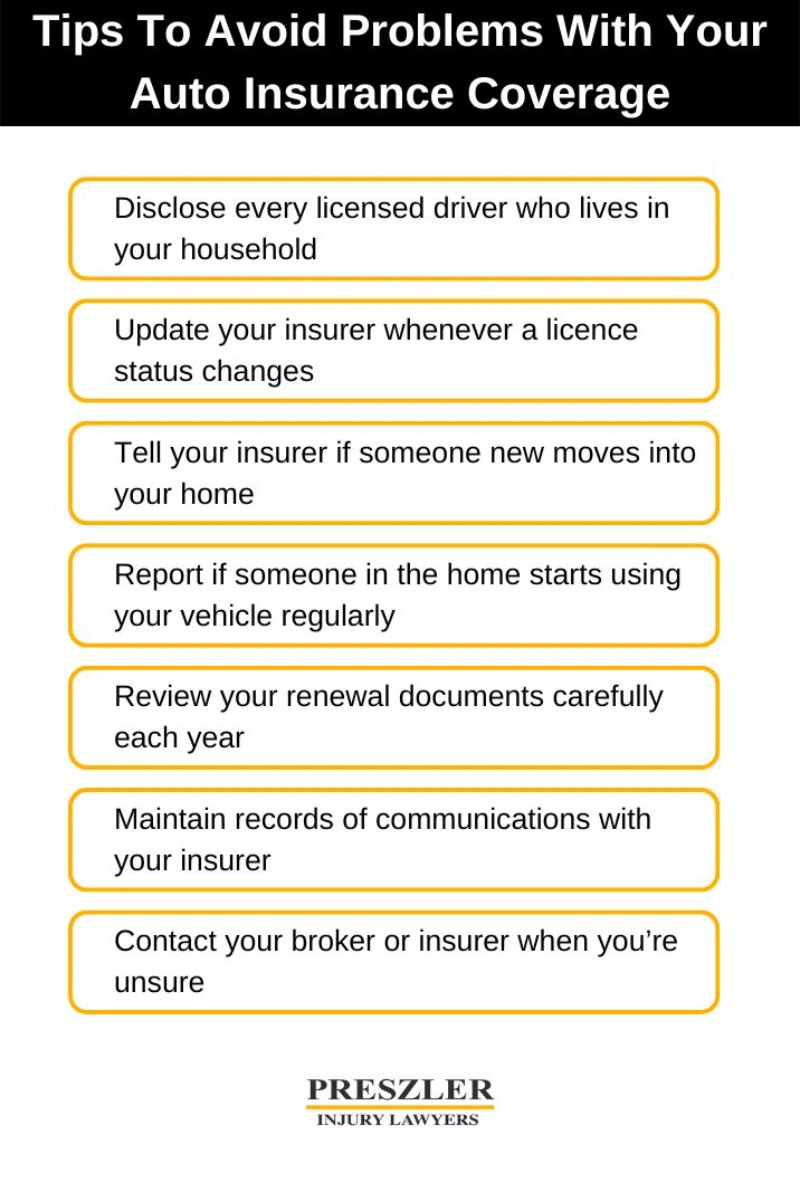

How to Avoid Problems With Your Auto Insurance Coverage

Many Ontario drivers run into avoidable insurance problems simply because they’re unsure what needs to be disclosed, when to update their insurer, or how “household drivers” are defined. Taking a few proactive steps can prevent a serious coverage dispute later on.

1. Disclose every licensed driver who lives in your household

Even if someone rarely drives, only uses the vehicle for short trips, or typically has access to another car, your insurer still needs to know they exist. Household members with a G1, G2, G, or out-of-province licence should always be listed.

2. Update your insurer whenever a licence status changes

A move from G1 to G2, G2 to a full license, or suspended to reinstated is considered a material change. These updates matter because they alter the risk profile your insurer has agreed to cover.

3. Tell your insurer if someone new moves into your home

This is one of the most common oversights. If a roommate, partner, or adult child moves in and holds a valid licence, your insurer must be told. Even infrequent access to the vehicle counts.

4. Report if someone in the home starts using your vehicle regularly

A household driver who begins using your car for work, errands, or school, even once or twice a week, may need to be added as an occasional driver. Without this disclosure, the insurer may argue the risk has increased without their knowledge.

5. Review your renewal documents carefully each year

Most Ontario insurers include questions such as “Are there any other persons in the household licensed to drive?” Renewals are legally treated as fresh opportunities to disclose. Ignoring these questions or assuming past details still apply can expose you to the same risks seen in Seetaram v. Allstate.

6. Maintain records of communications with your insurer

Keeping emails, renewal notices, and policy updates in a single folder helps if a dispute ever arises. Written proof can demonstrate that you properly disclosed information on time.

7. Contact your broker or insurer when you’re unsure

Many coverage issues arise from misunderstanding policy language. A quick call or email to your insurer with the question, “Do I need to list this person?” can prevent a denial of benefits worth thousands, or even hundreds of thousands, of dollars.

Speak With Our Motor Vehicle Accident Lawyers For A Free Consultation

Although the Court’s ruling in this case was understandable, it also puts the accident victim in an unfortunate position. After all, victims often rely on insurance coverage to receive compensation, as many drivers lack the financial resources to personally satisfy a substantial judgment.

Dealing with insurance companies is just one of many subjects with which an Ontario personal injury lawyer may be able to assist following a car accident.

Call 1-888-608-2111 to schedule a free, no-obligation consultation with one of our lawyers today. You can book a free consultation with our legal team using our website’s online booking form, live chat agent, text, phone, or email. Remember, you don’t pay unless we win, and this consultation is a free, no-obligation consultation.

Written by Thomas Kimball

Personal Injury Lawyer

Lawyer Thomas Kimball’s practice focuses on personal injury claims, including motor vehicle accident claims, premises liability claims, long-term disability claims, and catastrophic injuries.

More accident benefits Topics

Here’s more information on accident benefits related topics that we think you might find helpful.

car accident

|

February 25, 2026

Canadian Motor Vehicle Fatality Statistics

According to OECD data, Canada has seen a steady decline in fatal collisions and road deaths over the past three decades, mirroring trends in most…

boating accident

|

February 24, 2026

Boating Safety Tips for Ontario Residents

Ontario’s lakes and waterways offer some of the most beautiful boating experiences in Canada. Whether you enjoy fishing, watersports, sightseeing, or simply relaxing with family,…

accident benefits

|

February 24, 2026

Can You Settle Accident Benefits in Ontario?

If you have been injured in a motor vehicle accident in Ontario, you may already be receiving Statutory Accident Benefits. These benefits fall under the…

Speak With Our

Legal Team for FREE

Find Out if You Have a Case in Under 5 Minutes

Speak to a Lawyer Now!

We’re here to help.