5 Signs It’s Time to Call a Car Accident Lawyer in Toronto

At Preszler Injury Lawyers, we speak with people every day who aren’t sure whether a collision is “serious enough” to involve a lawyer. Indeed, as an accident victim, how do you determine if you should contact a car accident lawyer in Toronto? Minor fender benders with no injuries and minimal property damage usually don’t require legal intervention. However, when serious injuries, disputed fault, denied benefits, or low settlement offers enter the picture, timely legal guidance can help protect your rights.

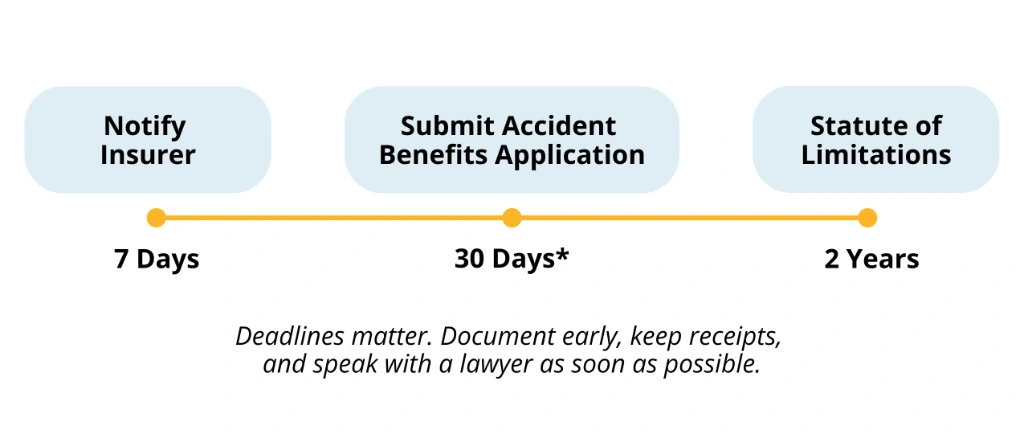

It’s best to contact a lawyer as soon as possible after your accident. Ideally, as soon as your immediate medical needs have been addressed. Ontario’s automotive insurance laws require that you notify your insurer within 7 days that you intend to seek Accident Benefits. In addition, you must submit your OCF-1 application within 30 days of receiving it. Working with a lawyer from the outset can help you avoid mistakes that might otherwise damage your claim.

If you’ve been injured in a Toronto motor vehicle collision and you’re unsure about your next steps, contact our Toronto car accident lawyers today. We offer free consultations, where we explain your options and help you move forward.

When to Call a Car Accident Lawyer in Toronto: Overview

- Report & Benefits: Notify your insurer of the accident within 7 days. Make sure you submit your Accident Benefits application within 30 days of receipt from your provider.

- Police/Centre Reporting: As of January 1st, 2025, the property-damage reporting threshold is $5,000 in Ontario. This means you must report your collision to the police immediately if the combined total damage sustained by each party is more than or equal to $5,000 and injuries have occurred. Where damage sustained appears above this threshold (but no injuries have occurred), you must attend a Collision Reporting Centre within 24 hours.

- Limitation Periods (tort): Most Ontario motor vehicle accident claims must be started within 2 years of the accident or discovery that you have threshold meeting impairments. Failure to adhere to this deadline may bar you from pursuing compensation.

1) Injuries are Significant or Symptoms Are Worsening

Bruises that heal quickly or minor scrapes likely do not require legal assistance. However, other types of red-flag injuries may warrant legal help. For example:

- Amputations

- Concussions

- Traumatic Brain Injuries (TBIs)

- Fractures

- Ligament tears

- Spinal cord injuries

- Chronic pain

- Permanent scarring

- Psychological trauma

- Or any other condition affecting work or daily function

By involving a lawyer as soon as possible, you can preserve medical evidence, align treatment referrals with benefits, and plan for income replacement and rehabilitation benefits under the Statutory Accident Benefits Schedule (SABS).

At Preszler Injury Lawyers, our Toronto car accident lawyers can fight for fair classification of your injuries (e.g., ensuring a brain injury is classified as catastrophic under your accident benefits claim). We will also quantify the short and long-term effects that your injuries have on your life. This way, we can ensure that you get the amount of compensation you truly deserve for your losses.

2) The Insurer Denies, Delays, or Limits Your Accident Benefits

Ontario’s no-fault insurance system guarantees that individuals injured in car accidents are entitled to Accident Benefits, regardless of who caused the crash. However, just because you’re entitled doesn’t mean the insurance company will make it easy.

Insurers often try to deny, delay, or restrict your benefits by:

- Denying entire categories of benefits (e.g., income replacement, attendant care, housekeeping, or medical and rehabilitation expenses)

- Minimizing the severity of your injury by placing you in the “Minor Injury Guideline (MIG)” instead of recognizing more serious impairments

- Reducing or challenging your eligibility for Catastrophic Impairment (CAT) status

- Requesting excessive paperwork or repeated assessments to stall your access to care

- Refusing to fund treatment plans submitted by your providers

- Cutting off income replacement benefits either before or at the two-year mark when the test for eligibility changes

How We Help Clients Challenge Insurer Denials

At Preszler Injury Lawyers, we act quickly and decisively when an insurer tries to deny or limit your rights. Our lawyers help you recover full and fair Accident Benefits by:

Ensuring Your Injury Classification Is Accurate and Fair

One of the most important parts of any claim is how your injury is classified by the insurance company:

- Minor Injury: capped at $3,500 in treatment

- Non-Minor Injury: eligible for up to $65,000

- Catastrophic Injury: eligible for up to $1 million in benefits

Insurers often default to the “minor” classification to limit what they have to pay. We review all medical documentation, commission further assessments if needed, and fight to reclassify your injury properly, whether that means moving you out of the MIG or building a case for catastrophic designation.

Disputing Denials Within Limitation Periods

We move quickly to dispute unfair insurer decisions, whether it’s an outright denial or an underpayment. All disputes must be filed within strict statutory deadlines, and we ensure your rights are preserved before the Licence Appeal Tribunal (LAT).

Handling Attendant Care Benefit Disputes

Attendant care benefits can often cost thousands of dollars per month, but insurers commonly deny or minimize them. We:

- Work with occupational therapists to complete Form 1 assessments

- Quantify the full scope of care required

- Dispute any denials or underpayments for attendant care

Securing Income Replacement Benefits (IRBs)

If your insurer delays or cuts off Income Replacement Benefits, either before or after the 104-week mark, we take immediate action. We coordinate:

- Functional capacity evaluations

- Medical opinions

- Vocational evidence

to meet the post-104-week disability threshold and fight for continued income support.

Ensuring All Required Forms Are Properly Submitted

Many claims are delayed or denied because of missing or incomplete forms. We handle and ensure proper submission of all mandatory documents, including:

- OCF-1: Application for Accident Benefits

- OCF-2: Employer’s Confirmation of Income

- OCF-3: Disability Certificate

- OCF-6: Expense Claims

- OCF-10: Election of Benefits – if requested by the insurer

We make sure your file is complete, thorough, and properly documented from day one.

Fighting for Access to the Right Treatment

Insurers don’t always fund the treatment you actually need. They often only approve what fits within what they believe you need. We:

- Review all treatment plans and medical reports

- Work with your healthcare providers to justify medical necessity

- File disputes when insurers deny or delay treatment authorizations

Our priority is your recovery, not the insurer’s bottom line.

Managing Catastrophic Impairment Applications

If your impairments are severe, you may qualify for Catastrophic Impairment (CAT) status. This designation drastically increases the benefits available to you. We:

- Identify which of the Catastrophic Impairment criteria best applies to your case

- Select experienced and credible assessors (OTs, psychologists, etc.)

- Time your application strategically for the strongest chance of success

We also respond to insurer denials and requests for rebuttal assessments where needed.

Timelines Matter. That’s Why We Stay Ahead of the Clock

The accident benefits system has strict, unforgiving deadlines:

- 7 days to notify your insurer of the accident

- 30 days to apply for benefits using the OCF-1 following the receipt of the application

- 2 years to dispute any benefit denials

We ensure every deadline is tracked and every dispute is filed on time. A missed deadline can cost you thousands or even your entire claim. We don’t let that happen.

3) If Fault is Being Disputed or You Are Blamed For the Accident

Although Ontario’s system provides certain accident benefits on a “no-fault” basis, fault is still a critical issue when it comes to tort claims. This is the part of your case where you can pursue compensation for pain and suffering, income loss, and future care costs. Unlike accident benefits, fault in tort claims is determined under the common law, not by pre-set regulatory rules.

That means the outcome depends heavily on how your claim is presented, such as what evidence is gathered, how the narrative is framed, and how liability is argued. A negligent driver may attempt to shift blame onto you, arguing that your own actions contributed to the crash. Without strong legal representation, your insurer or the at-fault party’s insurer may successfully assign you a percentage of liability, reducing your compensation accordingly.

In Ontario, if you’re found to be 50% or more at fault, your ability to recover damages in a tort action is reduced by that percentage. If you’re found 100% at fault, your tort claim is barred entirely. Even being found partially at fault (e.g., 25% or 30%) will proportionally reduce your final award.

That’s why timing, evidence, and legal strategy matter. At Preszler Injury Lawyers, we move quickly to preserve scene evidence, identify and interview witnesses, and gather helpful materials such as:

- Dashcam footage

- Police reports

- Intersection schematics or surveillance video

- Road condition data

- Expert accident reconstruction (when necessary)

Our legal team builds a strong, fact-based case that not only resists unfair blame but proactively establishes liability on the other driver, ensuring your entitlement to compensation is maximized.

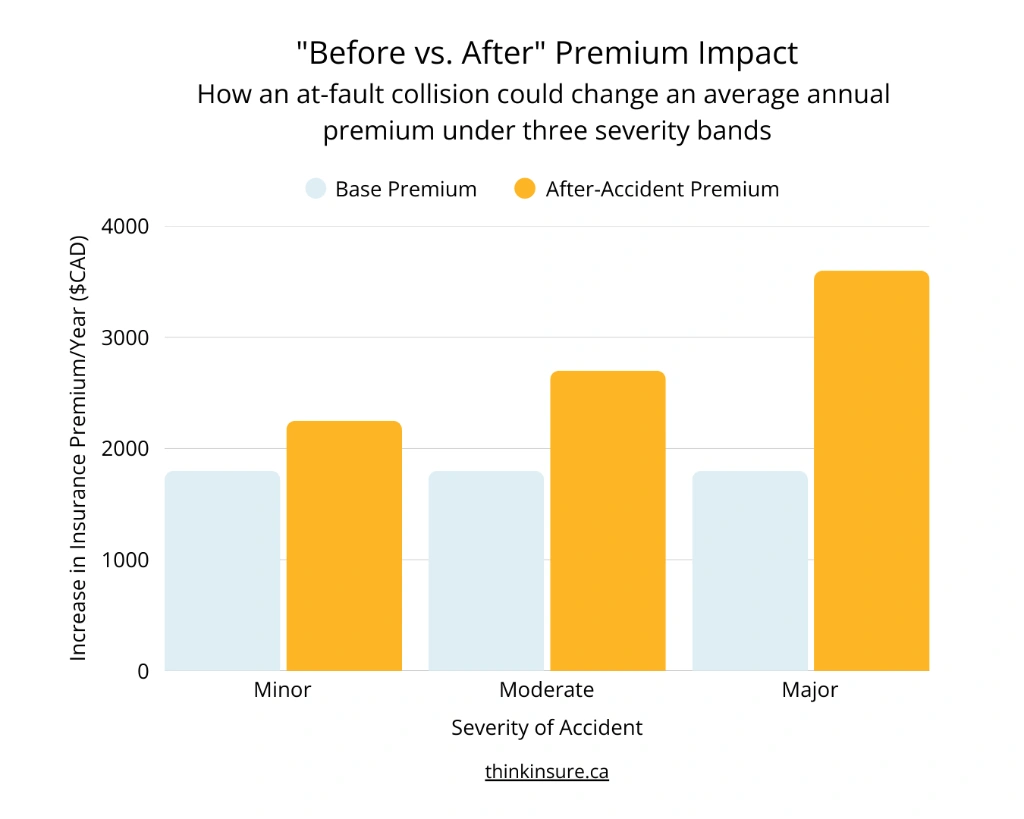

How Fault Can Affect Your Insurance Premiums

Even outside of your tort claim, being found at fault for a collision can impact your future auto insurance premiums. After an accident, your insurer will determine who was responsible based on the Insurance Act’s Fault Determination Rules, which provide standardized scenarios for assigning fault regardless of factors like weather, visibility, or road conditions.

If your insurer concludes that you were fully or partially at fault, it may consider you a higher-risk driver. This can lead to increased premiums for several years following the crash, depending on the severity of the accident and your prior driving record. Having knowledgeable legal representation can help ensure that fault is properly assessed and that your claim is positioned to protect both your compensation and your future insurability.

Real-Life Example: How an At-Fault Finding Could Change Your Auto-Insurance Premium

Illustrative only. Actual surcharges vary by insurer, record, and loss details.

4) You’re Confused by the Claims Process

Unfortunately, it is all too easy to make a mistake when applying for accident compensation after a motor vehicle collision. Between Collision Reporting Centre requirements, insurer notifications, medical forms, and evolving treatment plans, it’s easy to miss a step.

As of 2025, Ontario’s property damage reporting threshold is $5,000. This means that after a no-injury collision resulting in more than $5,000 in total damage, you must report the accident to a Collision Reporting Centre within 24 hours.

In addition, strict timelines apply when reporting your claim and applying for Accident Benefits. You must notify your insurer within 7 days of the accident and submit your completed Accident Benefits application within 30 days. Missing these deadlines can jeopardize your access to coverage altogether.

Similarly, failing to file a lawsuit or dispute a denial of benefits within the applicable limitation period can permanently affect your ability to recover compensation. Acting quickly and with the guidance of an experienced personal injury lawyer ensures that your rights are protected and your claim remains on track from the very beginning.

At Preszler Injury Lawyers, our legal team is professionally trained in handling Accident Benefits forms and other aspects of the litigation claim process. Our car accident lawyers will help you figure out what to file, when to file it, and how to properly document your losses.

5) The Settlement Offer You Receive is Too Low

An insurance company may offer you a certain amount of compensation that fails to address the severity of your injuries and other accident losses. For example, early settlement offers sometimes undervalue:

- Pain and suffering

- Income loss (past and future)

- Housekeeping/home maintenance costs

- Future care expenses

- And more

The Financial Services Regulatory Authority of Ontario (FSRA) annually adjusts the threshold at which the statutory deductible applies to non-pecuniary (pain and suffering) damages in motor vehicle accident claims

For example:

- In 2024, the statutory deductible applied to all pain and suffering awards under $153,509.39.

- In 2025, this threshold increased to $155,965.54.

These amounts are indexed annually and will continue to increase every January 1.

If your pain and suffering award is below the deductible threshold, the deductible is subtracted from your compensation. This can significantly reduce your recovery. However, if your damages are valued above the threshold, no deductible applies, and you retain the full award for non-pecuniary loss.

Understanding how these thresholds affect your potential recovery and what can be done to ensure your claim exceeds the deductible requires experienced legal strategy, advocacy and medical documentation. Our team works to ensure your injuries are fully assessed and presented to support the strongest possible compensation.

Contact Our Toronto Car Accident Lawyers Today For a Free Consultation

If you’re wondering when it’s time to call a Toronto car accident lawyer, the answer (almost always) is: as soon as possible. At Preszler Injury Lawyers, we offer completely free initial, no-obligation consultations to motor vehicle accident victims. That means, if you’re questioning whether your accident is serious enough to launch a legal claim, we can talk through your situation with you and let you know what your options may be.

At our firm, we:

- Clarify rights

- Coordinate medical, financial, and vocational evidence

- Track important deadlines

- Challenge denials

- Help educate insurers about the merits of your case

- And more

If the settlement you are offered isn’t fair, we’re ready to advocate for you and will endeavour to get you the settlement you deserve.

To discuss your legal options with a member of our team, call 1-888-608-2111 or fill out our online contact form now. We serve clients across Ontario and are available 24/7.

More Frequently Asked Questions

Speak With Our

Legal Team for FREE

Find Out if You Have a Case in Under 5 Minutes

Speak to a Lawyer Now!

We’re here to help.